The token was introduced on December 4, 2024, taking advantage of the popularity of social media star Haliey Welch. Promoted as an innovative project, $HAWK quickly gained traction, achieving a market capitalisation of $490 million in minutes.

Within hours, the token’s value had plunged by more than 90%, leaving investors with substantial losses. Allegations of a rug pull quickly arose.

Evidence of Fraudulent Practices

1. Highly Concentrated Token Holdings

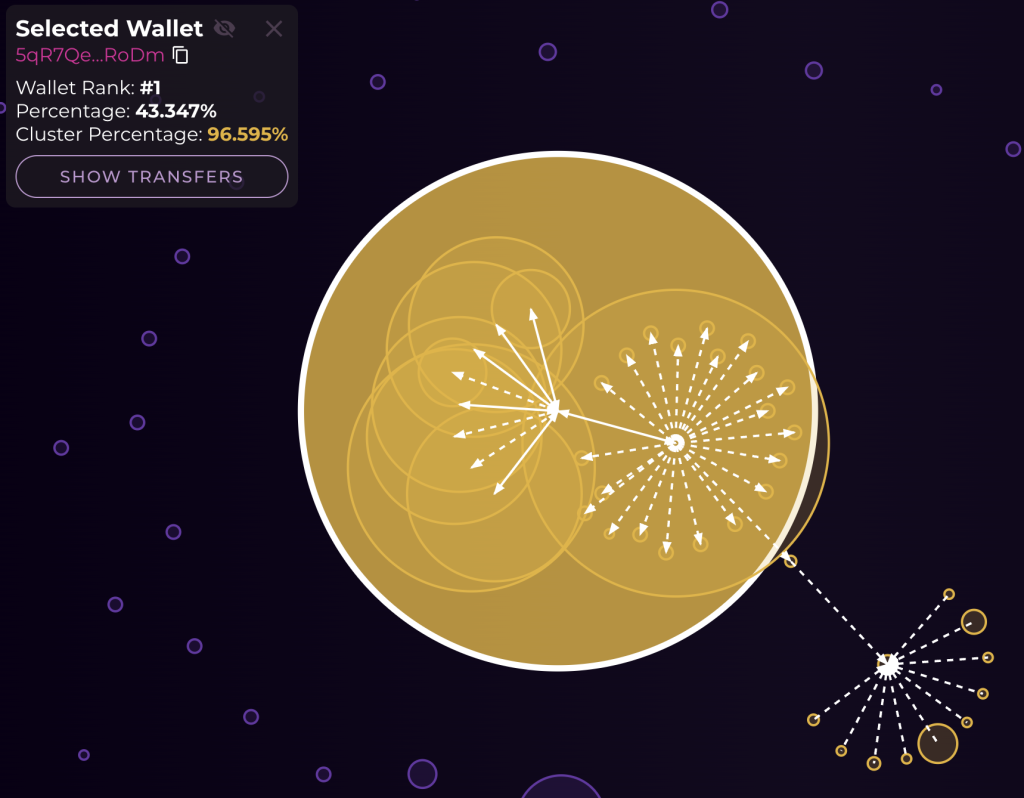

Blockchain analysis revealed a significant red flag: 97% of $HAWK tokens were concentrated in 285 wallets at launch. These wallets quickly offloaded their holdings, triggering a sharp price collapse.

You can access the on-chain data using buublemaps.io

2. Lack of Transparency in Tokenomics

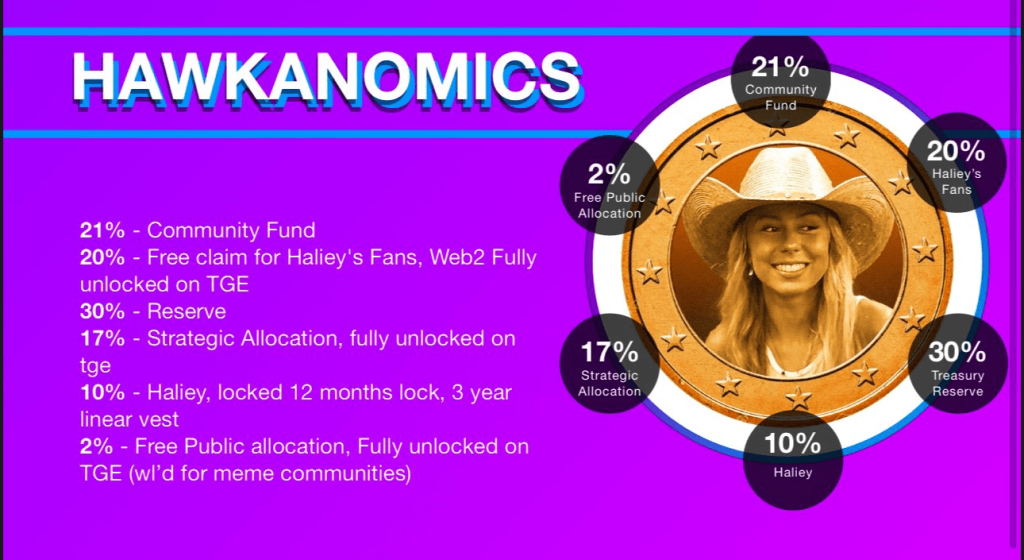

While the developers claimed that 10% of the total supply was allocated to the team with a one-year lockup, other large holders had no similar vesting schedules. This allowed insiders to sell immediately, profiting at the expense of retail investors.

3. Retail market negligence

The $HAWK token project’s 2% retail allocation contradicts its claim to be a “community-driven initiative”. Meme tokens, by definition, require heavy private investor’s participation to form powerful, devoted communities. Tokens like Dogecoin and Shiba Inu, for example, thrive on inclusive tokenomics, which ensures that a substantial proportion of tokens are available to retail consumers, encouraging involvement and ownership.

In contrast, Hawk Tuah’s token distribution significantly favoured insiders, with 97% of the supply concentrated in 285 wallets at launch, leaving only a small portion for the general public. This structure undermines the project’s declared purpose of assisting Hawk Tuah fans, implying that the project’s primary goal may have been to enrich a small group of individuals rather than developing a flourishing, community-driven ecology.

4. Excessive Fees Collected During the Rug Pull

Meme token transaction fees are relatively low, ranging between 0.1% and 1% for each trade. Shiba Inu (SHIB) is a popular payment method for small transactions due to its low fees.

The token’s 15% transaction cost is much higher than industry averages. This difference shows that such a high fee structure was designed to disproportionately enrich the project’s insiders or related foundations, raising concerns about the project’s legality and intent.

Although certain meme tokens might have features like redistribution fees to reward holders, it’s crucial to remember that these are usually far less than 15%. Hawk Tuah’s exceptionally high price is an anomaly that has to be investigated.

Investors should exercise caution when encountering tokens with such high transaction fees, as they can significantly impact the profitability of trades and may indicate underlying issues with the project’s design or intent.

5. Suspicious Foundation Activity

A key player in the alleged scam was the Tuah The Moon Foundation, a legal entity established to manage the project’s finances:

- Foundation Name: Tuah The Moon Foundation

- Location: Cayman Islands

- Created By: overHere Ltd. (registered in Hong Kong)

- Role: Managed the sale of tokens, collected transaction fees, and oversaw token distribution.

How the Rug Pull Worked

Initial Token Distribution

A small group of wallets received a disproportionate share of tokens during presales and private allocations. Ten wallets initially held 97% of the supply, while only 3% was available for public sale.

Massive Sell-Off

Large holders dumped their tokens immediately after the launch, crashing the price.

285 investors joined the presale for the token and 30% quickly sold all their tokens, while 23% sold some. These sellers made an estimated $3 million while causing the token value to drop over 90%.

You can analyse the chart using CoinMarketCap.

Fee Collection

The unusually high 15% fee on all buyer and seller transactions, claimed as a safeguard against snipers, not only had any effect but also allowed them to collect a beefy sum. The Tuah The Moon Foundation collected USD 3 million in transaction fees during the market activity.

Fund Transfer to Foundation

Proceeds from token pre-sales and fees were funnelled into the foundation, creating a legal separation between funds and individuals.

Offshore Transition

The foundation’s Cayman Islands location and the subsequent restructuring as an offshore entity further distanced those involved from accountability.

Ethical concerns

The use of Haliey Welch’s public image, with her direct involvement in the project, played a pivotal role in attracting investors.

While Welch claims to have cooperated with investigations and denies personal misconduct, her endorsement was instrumental in building trust among her followers, many of whom may not have understood the risks associated with cryptocurrencies.

The ethical responsibility of influencers remains a critical issue, especially when their involvement lends credibility to projects that ultimately harm investors.

Lessons Learned

For Investors

The Hawk Tuah case serves as a reminder of the importance of thorough due diligence when evaluating cryptocurrency projects.

Investors should carefully analyse tokenomics, ensuring that token distribution is transparent and includes lockup schedules to prevent early sell-offs by insiders.

Foundations linked to projects should be scrutinised to confirm they are designed to promote transparency and accountability, rather than serving as tools to obscure fund misuse.

High transaction fees, a lack of a clear profit roadmap, and aggressive marketing targeting inexperienced or non-crypto-savvy individuals should be seen as significant warning signs of potential fraud.

By remaining vigilant and questioning such red flags, investors can better protect themselves from scams in the volatile crypto market.

For Regulators

The Hawk Tuah case highlights the urgent need for stricter oversight and enforcement in the cryptocurrency industry, particularly in the creation and promotion of meme coins.

Today, it is remarkably easy to create a token “on the fly” using platforms that automate the process, eliminating the need for technical knowledge, a development team, or even a well-defined project purpose.

While this accessibility fosters innovation, it also opens the floodgates for bad actors to launch fraudulent assets with minimal effort or accountability.

To mitigate these cases, regulators could implement two simple practices, already in use in other scenarios:

- Know Your Customer (KYC) for Token Creators

- Mandatory Audits for Public Offerings

MiCA was a good opportunity to fix these issues. It still introduces several requirements that enhance transparency and accountability in the crypto market, but it could have gone further.

Conclusion

The Hawk Tuah token is a perfect example of the risks associated with unregulated cryptocurrency projects. While proving intent in cases like this can be challenging, the evidence strongly suggests a calculated scheme rather than poor planning.

The concentration of 97% of tokens in a few wallets, lack of transparency in tokenomics, immediate insider sell-offs, and unusually high transaction fees, align with patterns seen in deliberate rug pulls. Furthermore, the role of the Cayman Islands-based Tuah The Moon Foundation in collecting and shielding proceeds from scrutiny adds another layer of suspicion.

This case underscores the urgent need for both investor vigilance and regulatory oversight. Investors must scrutinise tokenomics, evaluate the legitimacy of associated foundations, and be wary of projects targeting inexperienced individuals or relying on influencer endorsements. At the same time, regulators must implement stricter controls, such as mandatory audits, KYC for token creators, and greater supervision of platforms facilitating rapid token creation.

The quick ascent and decline of Hawk Tuah highlight the risks present in the cryptocurrency market. They emphasise how crucial due diligence, openness, and aggressive regulation are to protecting investors and preserving faith in the dynamic ecosystem of digital assets.